Doctors going broke

@CNNMoney January 6, 2012: 9:39 AM ET

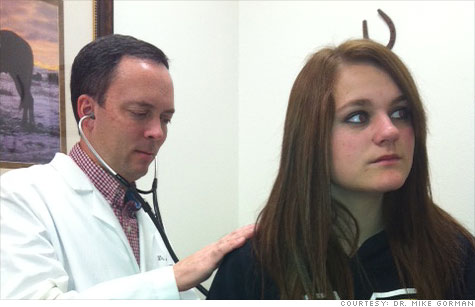

Dr. Mike Gorman has taken out an SBA loan to keep his rural solo practice running in Logandale, Nev. "If things don't improve fast, I will have no choice but to close my doors," he said.

NEW YORK (CNNMoney) -- Doctors in America are harboring an embarrassing secret: Many of them are going broke.

This quiet reality, which is spreading nationwide, is claiming a wide range of casualties, including family physicians, cardiologists and oncologists.

Industry watchers say the trend is worrisome. Half of all doctors in the nation operate a private practice. So if a cash crunch forces the death of an independent practice, it robs a community of a vital health care resource.

"A lot of independent practices are starting to see serious financial issues," said Marc Lion, CEO of Lion & Company CPAs, LLC, which advises independent doctor practices about their finances.

Doctors list shrinking insurance reimbursements, changing regulations, rising business and drug costs among the factors preventing them from keeping their practices afloat. But some experts counter that doctors' lack of business acumen is also to blame.

Loans to make payroll: Dr. William Pentz, 47, a cardiologist with a Philadelphia private practice, and his partners had to tap into their personal assets to make payroll for employees last year. "And we still barely made payroll last paycheck," he said. "Many of us are also skimping on our own pay."

Pentz said recent steep 35% to 40% cuts in Medicare reimbursements for key cardiovascular services, such as stress tests and echocardiograms, have taken a substantial toll on revenue. "Our total revenue was down about 9% last year compared to 2010," he said.

12 entrepreneurs reinventing health care

"These cuts have destabilized private cardiology practices," he said. "A third of our patients are on Medicare. So these Medicare cuts are by far the biggest factor. Private insurers follow Medicare rates. So those reimbursements are going down as well."Pentz is thinking about an out. "If this continues, I might seriously consider leaving medicine," he said. "I can't keep working this way."

Also on his mind, the impending 27.4% Medicare pay cut for doctors. "If that goes through, it will put us under," he said.

Federal law requires that Medicare reimbursement rates be adjusted annually based on a formula tied to the health of the economy. That law says rates should be cut every year to keep Medicare financially sound.

Although Congress has blocked those cuts from happening 13 times over the past decade, most recently on Dec. 23 with a two-month temporary "patch," this dilemma continues to haunt doctors every year.

Beau Donegan, senior executive with a hospital cancer center in Newport Beach, Calif., is well aware of physicians' financial woes.

"Many are too proud to admit that they are on the verge of bankruptcy," she said. "These physicians see no way out of the downward spiral of reimbursement, escalating costs of treating patients and insurance companies deciding when and how much they will pay them."

Donegan knows an oncologist "with a stellar reputation in the community" who hasn't taken a salary from his private practice in over a year. He owes drug companies $1.6 million, which he wasn't reimbursed for.

Dr. Neil Barth is that oncologist. He has been in the top 10% of oncologists in his region, according to U.S. News Top Doctors' ranking. Still, he is contemplating personal bankruptcy.

That move could shutter his 31-year-old clinical practice and force 6,000 cancer patients to look for a new doctor.

Changes in drug reimbursements have hurt him badly. Until the mid-2000's, drugs sales were big profit generators for oncologists.

In oncology, doctors were allowed to profit from drug sales. So doctors would buy expensive cancer drugs at bulk prices from drugmakers and then sell them at much higher prices to their patients.

"I grew up in that system. I was spending $1.5 million a month on buying treatment drugs," he said. In 2005, Medicare revised the reimbursement guidelines for cancer drugs, which effectively made reimbursements for many expensive cancer drugs fall to less than the actual cost of the drugs.

"Our reimbursements plummeted," Barth said.

Still, Barth continued to push ahead with innovative research, treating patients with cutting-edge expensive therapies, accepting patients who were underinsured only to realize later that insurers would not pay him back for much of his care.

"I was $3.2 million in debt by mid 2010," said Barth. "It was a sickening feeling. I could no longer care for patients with catastrophic illnesses without scrutinizing every penny first."

He's since halved his debt and taken on a second job as a consultant to hospitals. But he's still struggling and considering closing his practice in the next six months.

"The economics of providing health care in this country need to change. It's too expensive for doctors," he said. "I love medicine. I will find a way to refinance my debt and not lose my home or my practice."

If he does declare bankruptcy, he loses all of it and has to find a way to start over at 60. Until then, he's turning away new patients whose care he can no longer subsidize.

"I recently got a call from a divorced woman with two kids who is unemployed, house in foreclosure with advanced breast cancer," he said. "The moment has come to this that you now say, 'sorry, we don't have the capacity to care for you.' "

Small business 101: A private practice is like a small business. "The only thing different is that a third party, and not the customer, is paying for the service," said Lion.

"Many times I shake my head," he said. "Doctors are trained in medicine but not how to run a business." His biggest challenge is getting doctors to realize where and how their profits are leaking.

My biggest tax nightmare!

"On average, there's a 10% to 15% profit leak in a private practice," he said. Much of that is tied to money owed to the practice by patients or insurers. "This is also why they are seeing a cash crunch."Dr. Mike Gorman, a family physician in Logandale, Nev., recently took out an SBA loan to keep his practice running and pay his five employees.

"It is embarrassing," he said. "Doctors don't want to talk about being in debt." But he's planning a new strategy to deal with his rising business expenses and falling reimbursements.

"I will see more patients, but I won't check all of their complaints at one time," he explained. "If I do, insurance will bundle my reimbursement into one payment." Patients will have to make repeat visits -- an arrangement that he acknowledges is "inconvenient."

"This system pits doctor against patient," he said. "But it's the only way to beat the system and get paid."

*****

If you are a healthcare provider who would like to add an additional cash based stream of income, please call Beth Black at Orlampa Enterprises, Inc. at

(727) 492-8212.

Black specializes in

helping health care professionals implement holistic wellness programs into

their existing practice with the goal to educate both the health care provider

and the patient. The programs, which provide the health care professional with

a substantial additional income stream in this ever changing medical

marketplace, allow the patient to achieve true wellness instead of receiving only a

traditional treatment for symptoms. Orlampa Enterprises, proudly

utilizes highly researched products including nutraMetrix® nutritional

supplements.

Orlampa Enterprises' motto is "Eat well, exercise, and supplement intelligently."

Orlampa Enterprises' motto is "Eat well, exercise, and supplement intelligently."

To learn more about our health professional wellness programs, including our Gene SNP™ DNA Screening Analysis, please our website at: www.orlampahealth.com

No comments:

Post a Comment